In about 1900, England decided that it could either feed its horses, or feed its people, and began the process of shifting from horse power to other sources. This new ‘automobile’ seemed an excellent alternative, eliminating the coming agricultural crisis with no obvious negative impact.

At the same time in New York City, horse manure was accumulated on vacant lots until winter, and then hauled out on the ice to go away. Trains would bring feed into the city, but no-one hauled manure away. Someone calculated that the rate of growth of the horse population, and the rate of loss of vacant lots, by 1930 the vacant lots would be piled 3 storeys deep at the end of the summers. The internal combustion engine was an immediate cure for a looming environmental crisis.

In 1915, the world had more horses than ever before or since. 21.5 Million horses were shipped from North America to fight in the Great War, and none were sent back. The labour requirements for an IC engine were vastly smaller than that of a horse, so as horses were replaced with cars, people became unemployed and unemployable. In the 20’s, industries that benefitted from this new power source were booming, producing the Roaring 20’s, but the social structures were not in place to absorb those displaced by the boom, creating the seeds of the Great Depression.

Transitions are difficult. Horse to Car created the Great Depression. US to Middle East oil caused the Energy Crisis in 1973/74. Peak Conventional Oil caused the US debt crisis in 2008. And there are more transitions coming

Using the math for Hubbert’s curve, using symmetrical production curves, and using the known reserves as the total area under the curves, we will have coming:

2017 End of conventional open ocean fishing due to collapse of all principal fisheries

2020 Beginning of end of conventional agriculture due to soil loss, climate change

2023 Peak Natural Gas

2026 Not later than – maximum per capita Ecological Footprint

2040ish Peak Fossil Carbon production – this is somewhat flexible, depending on what is done with Tarsands

2042 Peak Coal

2060ish Peak Usable Fossil Energy (extraction x efficiency)

So this means that by 2020, we all need to have the capacity to grow our own food. We don’t necessarily have to grow our own food, just have the capacity (skills, land) to do so.

It also means that after 2060, all of our economic development will be independent of energy consumption. When planning projects that have a lifespan of greater than 50 years, consideration of how to do something with a much higher energy cost is required. Be a net energy producer by 2060, which probably means investing in Nega-watts before Mega-watts.

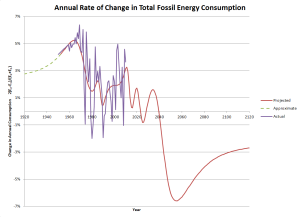

This graph assembles all of the existing data from 1950 to 2012, and plots a series of Hubbert Curves for each major cycle of Natural Gas, Coal, and Oil, and superimposes all of them together. Historically, energy consumption has been linked directly with GNP, and therefore to some extent to Quality of Life. The red line is a reasonable estimate of what we can expect, if we allow our quality of life to be tied directly to energy consumption. It considers improvements in energy efficiency increasing to 80% system efficiency following an ‘S’ curve that is based on historic trends. It also considers the known reserves of all fossil fuels. The model is artificially smooth beyond 2040 because the inflection points of the superimposed curves have not yet occurred, so we can not make any reasonable prediction.

Overall, though, there are going to be a variety of shocks in the works that will need people to be nimble to get through. Invest in energy savings today while supply is still increasing – my back of the envelope numbers say even a 40 year simple payback on your energy investment will be a good investment, once we consider that energy will inflate far faster than wages after about 2040.